You have a unique set of financial goals

We’re here to help you pursue them.

Even before becoming a client, our financial planning professionals will analyze your total financial blueprint, personal goals, and external market conditions. Then, we’ll present you with a custom financial plan tailored to your unique situation.

Our core services

We work with clients in pursuit of financial goals in the following areas:

-

Retirement Planning

Assess the feasibility of various scenarios and consider ways to improve your current plan.

-

Tax Planning

Get acquainted with your tax situation and strategies for ensuring it remains efficient.

-

Cash Flow and Budgeting

Where should you be saving and how much? We’ll get you moving in the right direction.

-

Insurance Planning

Review your current policies, quantify coverage needs and identify cost savings while keeping your family protected from various risks.

-

Estate Planning

Review estate documents, update beneficiary designations and more, so you’re confident all assets are in order.

-

Education Planning

Learn about savings options to help fund your children’s educations.

-

Investment Planning

Optimize investments to achieve your goals.

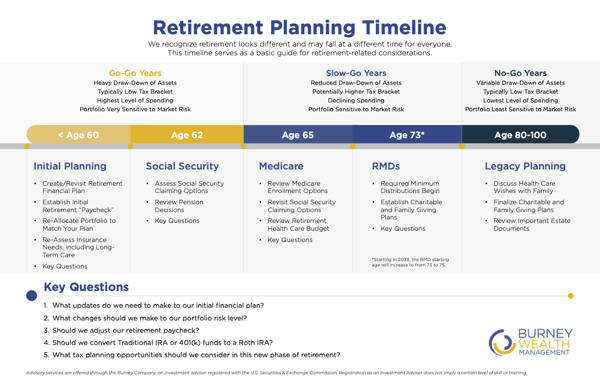

Retirement Planning

Check out our Retirement Planning Timeline:

Watch our video about Required Minimum Distributions:

Tax Planning

Watch our Tax Planning Demo video:

Watch our video about Tax Returns:

Insurance Planning

Read our article Qualifying for Health Insurance Tax Subsidies in Retirement

Read our article Medicare 101: The Basics of Medicare

Education Planning

Read our article Now is the Time...529!

Read our article The Alphabet Soup of Education Savings Vehicles

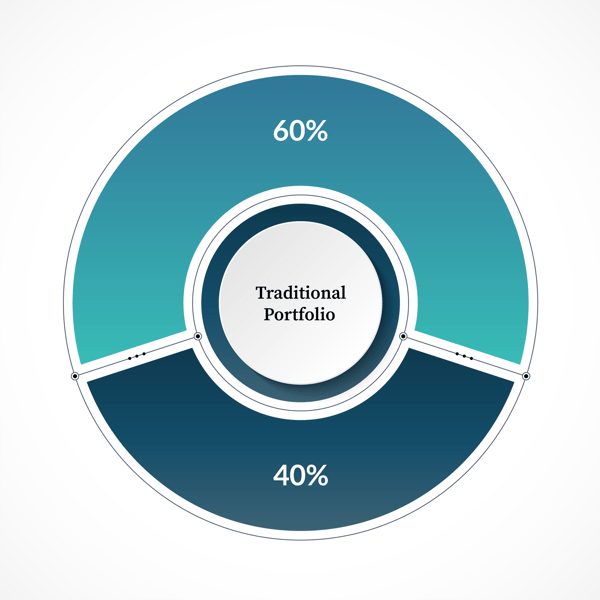

Investment Planning

Read our article Challenging the balanced portfolio

Download the Investment Management ChecklistRead our article Successful Investors Keep the Faith

Retirement Planning

Assess the feasibility of various scenarios and consider ways to improve your current plan.

Check out our Retirement Planning Timeline:

Watch our video about Required Minimum Distributions:

Tax Planning

Get acquainted with your tax situation and strategies for ensuring it remains efficient.

Watch our Tax Planning Demo video:

Watch our video about Tax Returns:

Cash Flow and Budgeting

Where should you be saving and how much? We’ll get you moving in the right direction.

Read our article: The importance of your financial health

Insurance Planning

Review your current policies, quantify coverage needs and identify cost savings while keeping your family protected from various risks.

Read our article Qualifying for Health Insurance Tax Subsidies in Retirement

Read our article Medicare 101: The Basics of Medicare

Estate Planning

Review estate documents, update beneficiary designations and more, so you’re confident all assets are in order.

Read our article Estate Planning Essentials

Education Planning

Learn about savings options to help fund your children’s educations.

Read our article Now is the Time...529!

Read our article The Alphabet Soup of Education Savings Vehicles

Investment Planning

Optimize investments to achieve your goals.

Read our article Challenging the balanced portfolio

Download the Investment Management ChecklistRead our article Successful Investors Keep the Faith