Stay ahead of any risks and opportunities.

With access to advanced planning, modeling, and tax-efficient investment tools, our fiduciaries (someone obligated to act in your best interest) help you stay ahead of any risks and opportunities.

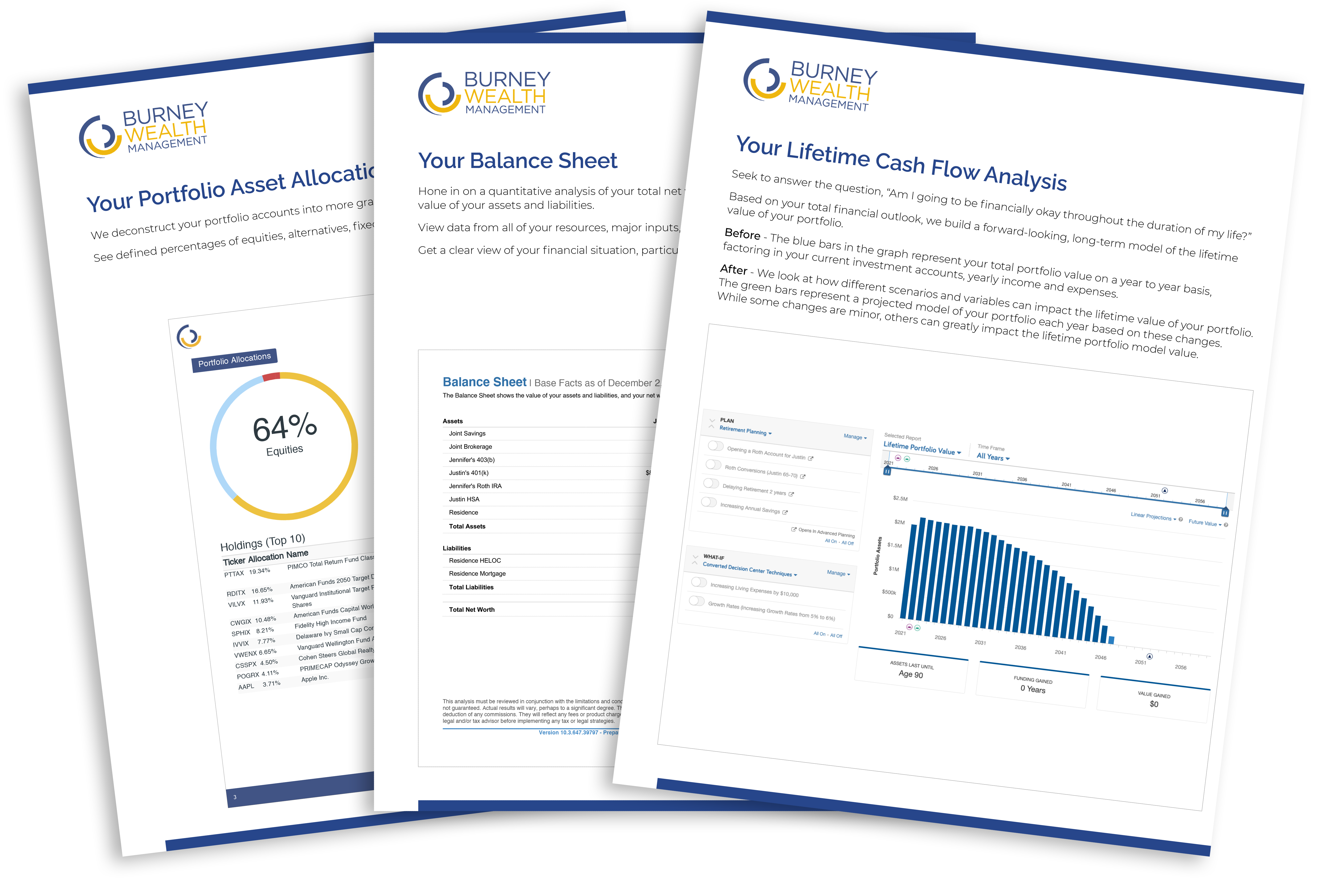

Align your financial plan and long-term goals with your investment objectives.

Your investment strategy is an important piece of your comprehensive financial plan.

We get to know you and your goals before developing a custom financial plan that’s aligned with your long-term goals. This way, your investment strategy takes into account your family’s needs and what you hope to achieve.

Maximize opportunities that come your way with a dedicated team of advocates.

You deserve more than a run-of-the-mill investment strategy.

We’ll work closely with you to identify your comfort level with market volatility so your portfolio risk level is appropriate, and we’ll define the rate of return needed to meet your specific objectives, adjusting your asset allocation as warranted.

Let our team invest your portfolio for you using our specialized, tax-efficient US equity strategy and forward-looking asset allocation models designed to balance risk and return, customized to your personal situation.